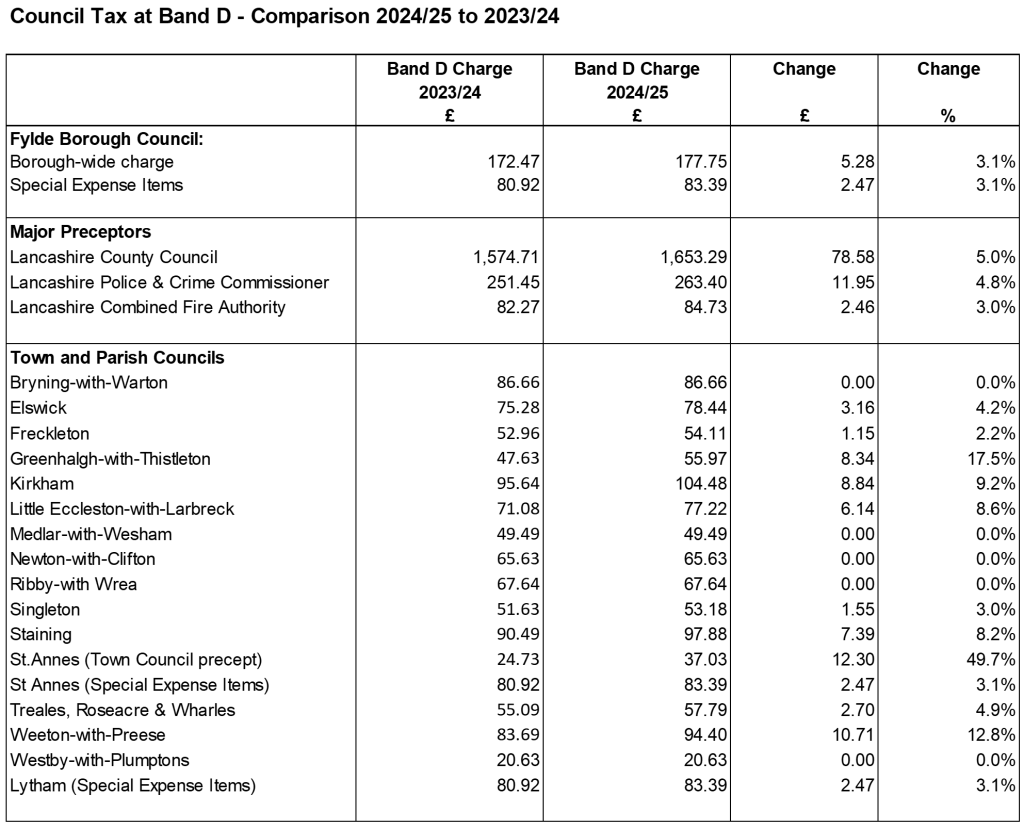

The following list shows the changes in respect of Lancashire County Council, Lancashire Police and Crime Commissioner, Lancashire Combined Fire Authority, Fylde Borough Council (including Special Expenses) and Parish / Town Council precepts compared with last year:

The change on last year will depend on which area you live in. The following list shows the total change in respect of Lancashire County Council, Lancashire Police and Crime Commissioner, Lancashire Combined Fire Authority, Fylde Borough Council (including Special Expenses) and Parish / Town Council precepts compared with last year:

Total change in bill compared to previous year:

- Lytham 7 % increase in total

- Bryning-with-Warton 5 % increase in total

- Elswick 7 % increase in total

- Freckleton 7 % increase in total

- Greenhalgh-with-Thistleton 0 % increase in total

- Kirkham 9 % increase in total

- Little Eccleston-with-Larbreck 9 % increase in total

- Medlar-with-Wesham 6 % increase in total

- Newton-with-Clifton 6 % increase in total

- Ribby-with-Wrea 6 % increase in total

- Singleton 7 % increase in total

- Staining 9 % increase in total

- St Annes 2 % increase in total

- Treales, Roseacre and Wharles 7 % increase in total

- Weeton-with-Preese 0 % increase in total

- Westby-with-Plumpton 7 % increase in total

This is because in parished areas you will pay an amount to the local parish or town council, and some areas also pay special expenses. The increases will be different for each area. Fylde Borough Council collects Council Tax on behalf of a number of public sector organisations in the area. We collect the money from you and pass it on to them. Your bill is therefore made up of:

- The amount payable to Lancashire County Council (including the precept specifically to be used in support of Adult Social Care costs);

- The amount payable to Lancashire Police and Crime Commissioner;

- The amount payable to Lancashire Combined Fire Authority;

- The standard Council Tax payable to Fylde Borough Council;

- Special expenses (if applicable); and

- The amount payable to your local Parish/Town Council (if applicable).

Fylde Borough Council recovers an element of its Council Tax via Special Expenses. These charges are applicable in Lytham and St Annes. Special Expenses in the main are charges for the upkeep of parks and the maintenance of “open space assets” (see next question for a definition of open space assets).

The special expense charge applies in these areas because Fylde Borough Council owns and maintains open space assets in these areas. In other areas of the Borough open space assets are owned and maintained by parish councils who will charge residents accordingly for these services.

In the interests of fairness and balance with this approach Fylde Borough Council charges special expenses in Lytham and St Annes to recover the costs of maintaining the assets it owns. The figure quoted on individual bills for Fylde Borough Council is dependent upon the overall level of “special expenses” recoverable each year.

These are parks, gardens, play areas, and open spaces within the Borough. Examples include Ashton gardens and promenade gardens in St Annes, and the Green in Lytham.

Special expenses are charged by Fylde Borough Council in St Annes because even though there is a Town Council, Fylde Borough Council owns and maintains open space assets in St Annes, as it does in Lytham. In the interests of fairness and balance with all other areas of the Borough, Fylde Borough Council recovers these costs via the special expense charge in St Annes. In the other areas, where parish councils own the assets, the costs are charged to local residents by parish councils.

Every 1% increase in Fylde Council’s element of Council Tax raises approximately an extra £70,000

Every Council is required by law to declare its “Band D equivalent” Council Tax. This is the figure upon which the annual increase from the previous year is calculated. It is a very complicated calculation which converts the number of properties in other bands to “band D equivalents”.

Full details of how much people pay in all bands and all areas can be found here.

Both of the individual elements of council tax charged by Fylde Council (i.e. the standard borough-wide charge and the special expense charge) have increased for 2024/25 by 3.1% as compared to the level as for 2023/24. This is what you will see on your council tax bill.

However, the AVERAGE council tax is changing by a slightly different amount. Changes to the council tax base year-on-year means that the average Band D council tax charge has increased by 2.99% for 2024/25.

The AVERAGE council tax is a statutory calculation which is worked out by comparing the current year’s AVERAGE charge with the previous year’s AVERAGE charge. The AVERAGE council tax charge for each year is calculated by dividing the total council tax income receivable by the number of chargeable properties (known as the taxbase). Because there are two components to the taxbase – the borough wide component and the Lytham St Annes component – and these usually change each year at different rates – the AVERAGE council tax charge will almost always change at a slightly different rate than the change in the two elements individually. For this year the AVERAGE increase is 2.99%.

It is worth noting that nobody actually pays the average – if you live in Lytham or St Annes you will pay both the borough wide charge and the special expense charge (which in total is higher than the average charge in Fylde), and if you live outside this area you will pay only the borough wide charge (which is lower than the average charge in Fylde).

For 2024/25 there is an overall Council Tax increase of 2.99% (£6.54), resulting in an average Band D charge for 2024/25 of £225.43 (compared to the average Band D charge for 2023/24 of £218.89)

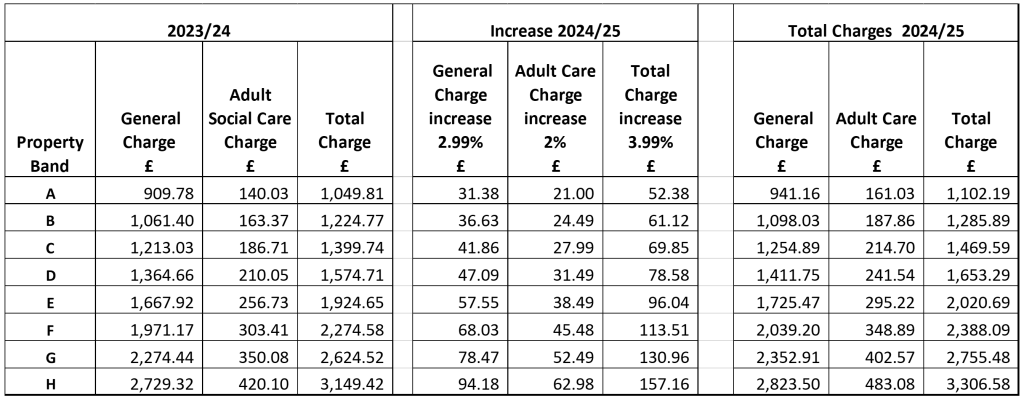

To recognise the particular demand that upper-tier councils (such as Lancashire County Council) face in respect of the growing cost of adult social care, the government has allowed these councils to charge an additional precept to contribute towards the cost of adult social care, in additional to the general increase that relates to funding for general purposes.

Therefore there are now two elements of the Council Tax charge that relate to Lancashire County Council:

- The general Lancashire County Council charge; and

- The Lancashire County Council Adult Social Care charge.

For 2024/25 Lancashire County Council is to charge an additional 2% Adult Social Care precept in addition to the 2.99% general increase (actually shown on the bills to one decimal place as 3.0%), resulting in an overall 4.99% (shown as 2% and 3% on the bills) increase in the part of the Council Tax that is charged by Lancashire County Council.

The actual charges vary according to the Council Tax band in which an individual property is placed according to the usual proportions (see earlier question on Council Tax bandings).

The charge for Adult Social Care is explained in the previous question.

In relation to the increase shown on bills, the government have issued regulations which stipulate how the charge from Lancashire County Council for Adult Social Care is presented on bills, and we have followed the regulations. What appears on 2024/25 bills for Lancashire Adult Social Care is the 2024/25 charge PLUS the Adult Social Care charge levied for previous years i.e. the cumulative Adult Social Care charge which is being charged for 2024/25.

In line with the regulations, the percentage increase shown on the bill is the 2024/25 element of the charge for Adult Social Care as a percentage of the total amount that LCC charged for 2023/24 (that being the main LCC charge PLUS the Adult Social Care charge), which equates to 2.0%.

Effectively for 2024/25 Lancashire County Council have increased their elements of the bill by 4.99% in total – split between 2.99% (actually shown on the bills to one decimal place as 3.0%) on their main charge, and 2.0% for Adult Social Care.

The table below sets out the charges for 2023/24, the increases for 2024/25 and the total charge for 2024/25 for each element of the LCC charge, along with the total charge for each property band.

Along with your Council Tax Bill for 2024/25 you will have received an explanatory leaflet containing further information about your Council Tax and the services that each local authority shown on the leaflet provide.

The following questions relate to the Council Tax leaflet.

No, that is not what this section is intended to explain. This section shows the net total cost to Fylde Council of delivering each of the services shown (such as Tourism and Leisure, and Economic Development & Regeneration). This is not an exhaustive list of the functions that the Council fulfills, nor the full range of services delivered. It is intended to show a snapshot of the weekly cost per household of some of the more prominent services that we deliver.

The services that are delivered by Fylde Council are funded by a range of means, including a share of local business rate income, government grants, income from services such as off-street car parking – as well as from the Fylde Council share of Council Tax.

Fylde Borough Council collects Council Tax on behalf of a number of public sector organisations in the area. We collect the money from you and pass it on to them. Your bill is therefore made up of amounts payable to Lancashire County Council (including the precept specifically to be used in support of Adult Social Care costs); Lancashire Police and Crime Commissioner; Lancashire Combined Fire Authority; Fylde Borough Council; Special expenses (if applicable); and your local Parish/Town Council (if applicable).

The amount that you pay will also depend upon which Council Tax Band your property has been assessed at by the Valuation Office Agency.

The estimated weekly cost per household of key services provided Fylde Borough Council as shown on the leaflet have been calculated by taking the latest estimated net total cost of each of the services (such as collection of refuse and recycling, and tourism and leisure) and dividing this by the number of households in the borough and then further dividing this by 52 to get an estimated net cost per household per week.

The services provided by Fylde Council include the following:

- Collection of Refuse and Recycling

- Street Cleaning

- Economic Development and Regeneration

- Sea Defence Project Management and Delivery

- Town Centre Management

- Planning Services including Heritage and Conservation

- Building Control Services

- Flood and Drainage Advisory Management

- Off-street Car Parking Provision

- Tourism and Leisure Services including Events, Sports Development and Swimming

- Community Projects Fund

- Support for Partner Organisations including Lowther Theatre and Fylde Citizens Advice

- Beach and Sand Dunes Management

- Parks and Open Spaces Maintenance and Development (including Lytham Green, Lowther Gardens, Park View4U, Fairhaven, St Annes Promenade Gardens, Ashton Gardens St Annes)

- Children’s Play Area Provision

- CCTV Provision

- Housing and Homelessness Services

- Cemetery and Crematorium Services

- Delivering Disabled Facilities Adaptations

- Public Health including food safety, inspection of premises, licensing and public toilets

- Elections

- Local Tax Collection – Council Tax and Business Rates

The key services provided by Lancashire County Council are as follows:

- Highways & Transport including on-street parking

- Education

- Care for the elderly & disabled

- Children’s Services & Child Protection

- Planning

- Libraries

- Public Health

- Recycling Centres

- Trading Standards

- Registrar & Coroners Services

The types of services provided by Town and /Parish Councils are as follows:

- Community Buildings / Village Halls

- Local Open Spaces Maintenance

- Playing Fields

- Local Community Events and Projects

- Neighbourhood Plans

- Local Cultural Events